Smart Tools for Smart Creators ✅

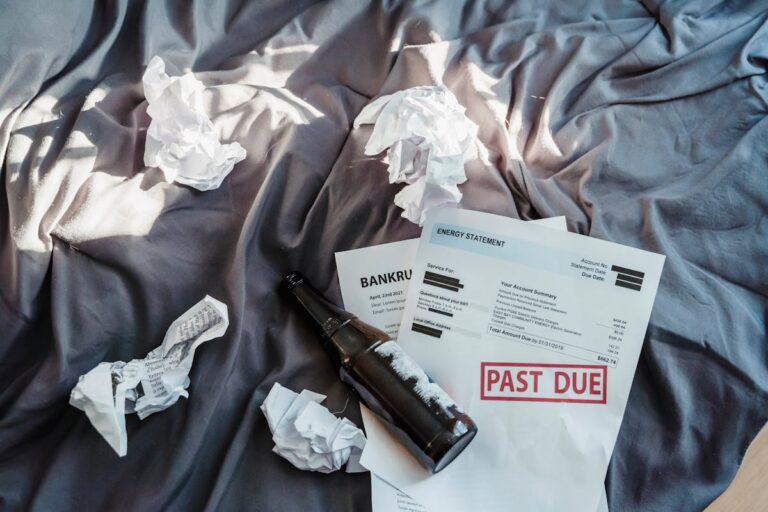

We’ve all been there: scrolling through an online store, popping into a mall “just to look,” or walking past a shop window and suddenly finding ourselves clutching a shopping bag with something we never intended to buy. Later, we ask ourselves, “Why did I even buy this?” Understanding the psychology behind why we spend on things we don’t need can illuminate not just our spending habits, but deeper patterns of thought and emotion that influence everyday life.

The Emotional Triggers Behind Spending

Buying is rarely just a rational choice. Emotions play a huge role in our decision-making. Here’s how:

- Retail Therapy

It’s no coincidence that spending money can feel like a mini boost of happiness. When we buy something, our brain releases dopamine, the “feel-good” neurotransmitter. That brief high can be addictive. Over time, shopping can become a coping mechanism for stress, sadness, or even boredom, leading to purchases that serve emotional needs rather than practical ones. - Fear of Missing Out (FOMO)

Marketing thrives on urgency. Flash sales, limited editions, or trending items create a sense of scarcity and fear that if we don’t act now, we’ll miss out. Psychologically, our brains react as if we’re at risk of losing something valuable, prompting impulsive decisions. - Identity and Status

Often, purchases are about projecting an image—whether consciously or unconsciously. Buying a luxury handbag, the latest gadget, or even just a particular brand can feel like a way to signal success, taste, or belonging. This desire to reinforce identity can override logic or budget considerations. - Reward and Self-Compassion

Sometimes we buy things to reward ourselves, especially after achieving a goal or enduring a difficult period. While occasional self-reward is fine, it can become habitual when shopping becomes the primary way we celebrate or comfort ourselves.

The Cognitive Biases That Fuel Impulse Buying

Understanding our mental shortcuts can shed light on why we buy unnecessarily:

- The Anchoring Effect

Sales often use “original price” vs. “discounted price” strategies. Seeing a $200 coat marked down to $120 tricks the brain into perceiving value, even if we never needed a coat in the first place. The original price becomes an anchor, making the sale seem irresistible. - The Endowment Effect

Once we touch, hold, or imagine owning something, we tend to overvalue it. Even just trying on a pair of shoes can create a sense of ownership, making it psychologically harder to walk away without buying. - Loss Aversion

Humans fear loss more than we value gain. Marketers leverage this by highlighting what we might miss out on. Phrases like “only 2 left in stock” trigger a fear of loss, nudging us toward purchases that aren’t truly necessary. - Decision Fatigue

Shopping, especially online, bombards us with endless choices. After too many decisions, our brain’s ability to resist impulses diminishes, and we often default to buying just to resolve the mental overload.

Social Influences and Subtle Pressures

Our spending is also influenced by those around us and the environments we inhabit:

- Peer Influence: Seeing friends, colleagues, or influencers with certain products can create a pressure to “keep up,” even if it’s unnecessary. Social media amplifies this effect, constantly showcasing what others own or aspire to own.

- Cultural Norms: Societies often link happiness and success with consumption. Advertising, media, and societal expectations normalize the idea that buying is synonymous with living well.

- Retail Design: Stores and e-commerce platforms are designed to maximize purchases. Strategic layouts, color schemes, and personalized recommendations encourage more buying than we intended.

Breaking the Cycle: Mindful Spending

Understanding these psychological patterns is the first step to taking control of your spending. Here’s how to start:

- Pause Before Purchasing

Implement a waiting period—24 hours for online buys, a week for larger items. This gives your emotional brain time to cool down and your rational brain a chance to weigh necessity versus impulse. - Identify Emotional Triggers

Keep a small journal of your purchases. Note your mood, situation, and motivation. Over time, patterns emerge—perhaps stress triggers certain types of spending, or boredom leads to online shopping. - Set Clear Financial Goals

When your spending aligns with tangible goals—saving for travel, an emergency fund, or investments—the emotional pull of impulsive buying weakens. Goals act as a compass for decision-making. - Limit Exposure

Unsubscribe from marketing emails, mute shopping notifications, and avoid scrolling through online marketplaces out of habit. Reducing exposure reduces temptation. - Redefine Reward Systems

Find alternatives to shopping that make you feel rewarded: a walk, a creative project, or connecting with friends. When happiness isn’t tied to purchases, you break the habit loop.

Understanding Yourself Beyond Spending

The tendency to buy things we don’t need isn’t simply a flaw; it’s part of human psychology. Our brains are wired to seek pleasure, avoid loss, and navigate social landscapes. Recognizing these tendencies allows us to act with intention rather than habit. Over time, mindful spending becomes less about restriction and more about freedom—the freedom to choose purchases that genuinely add value to our lives rather than filling emotional voids.

Every unnecessary purchase avoided is a small victory—not just for your wallet, but for your self-awareness, your goals, and your long-term well-being.

Smart Ideas, Straight to You

Subscribe for free updates — posts, tools, and strategies to help you create smarter and grow faster.